when are house taxes due in illinois

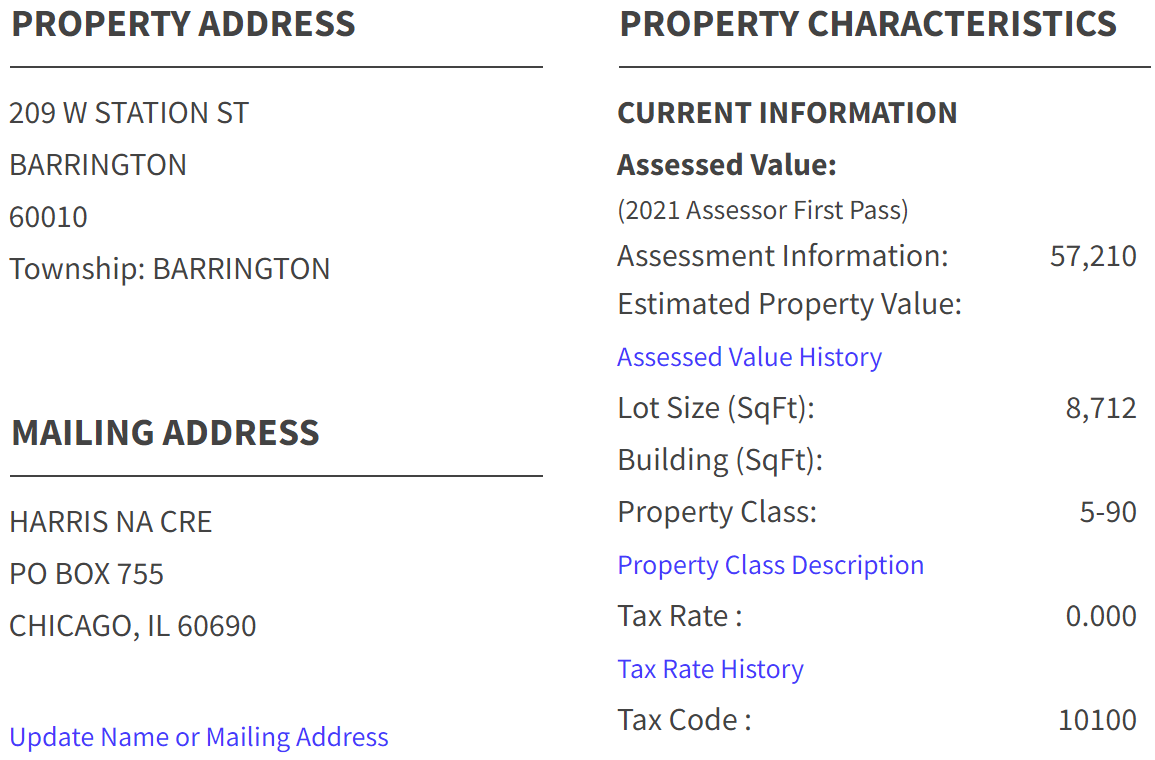

To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500000 or less if filing jointly. Property Tax Payment Dates.

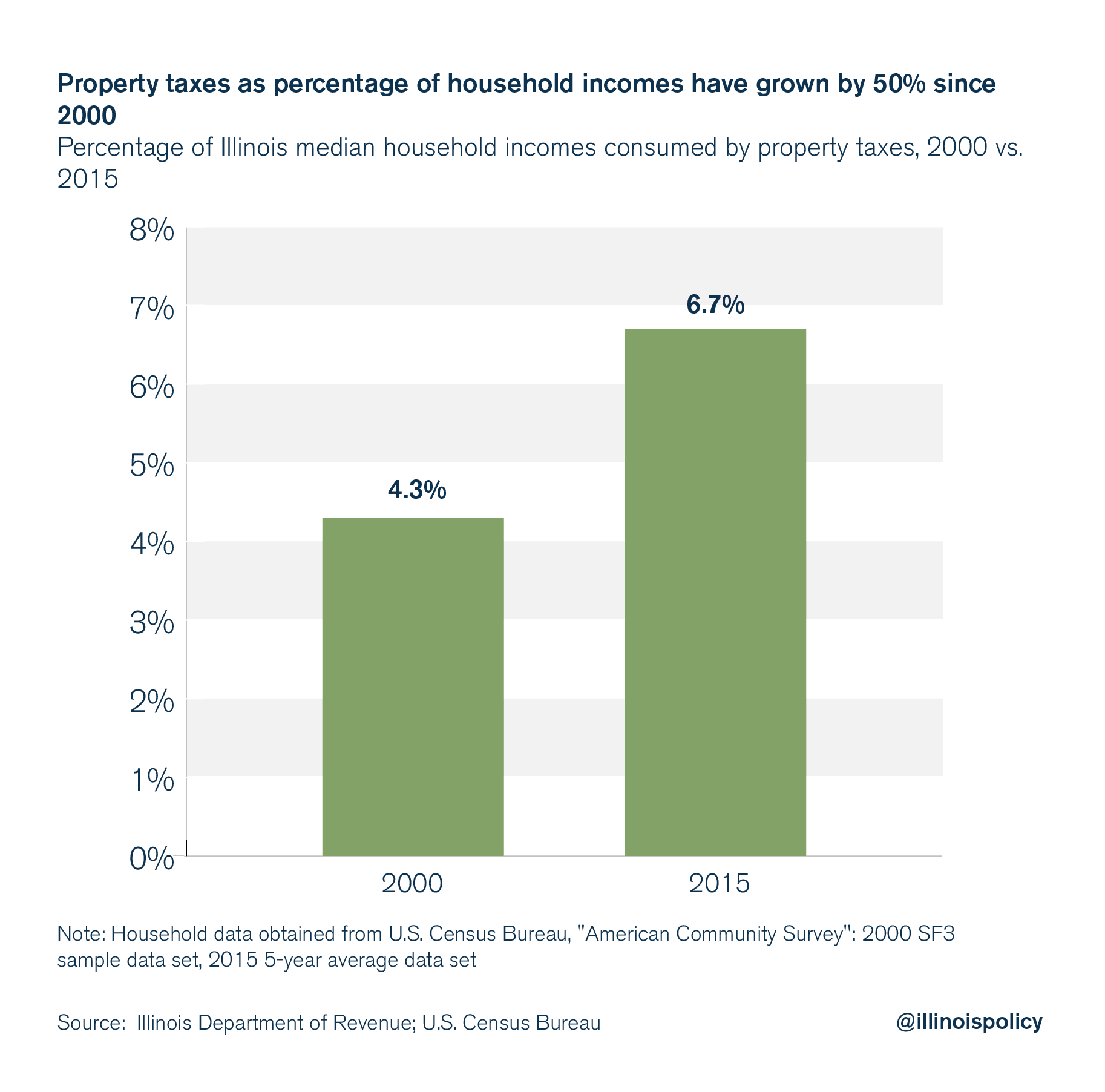

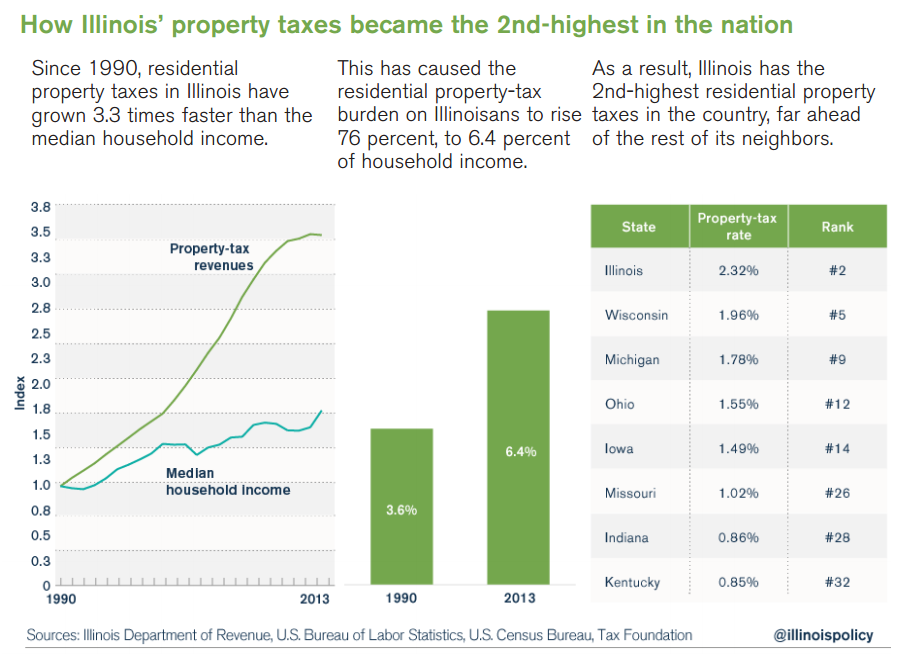

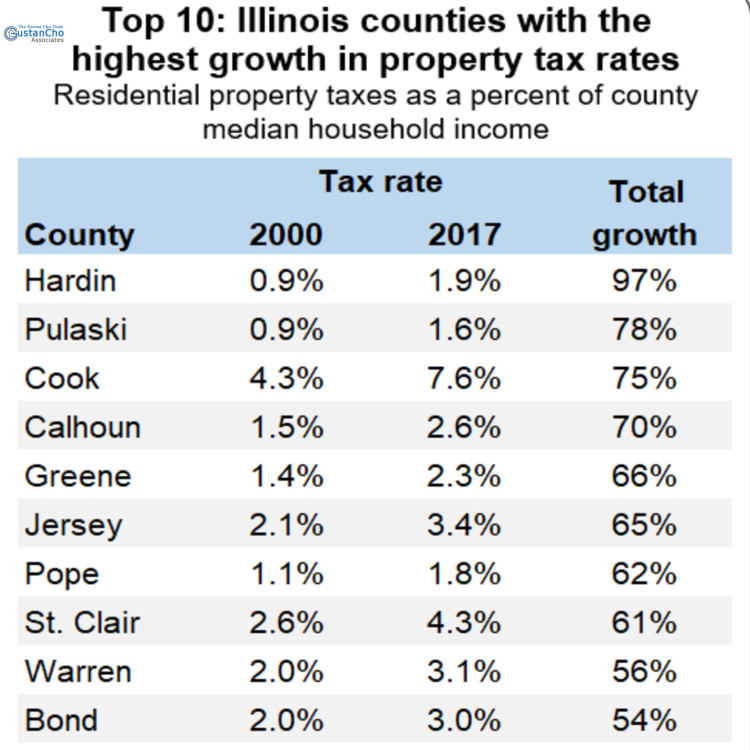

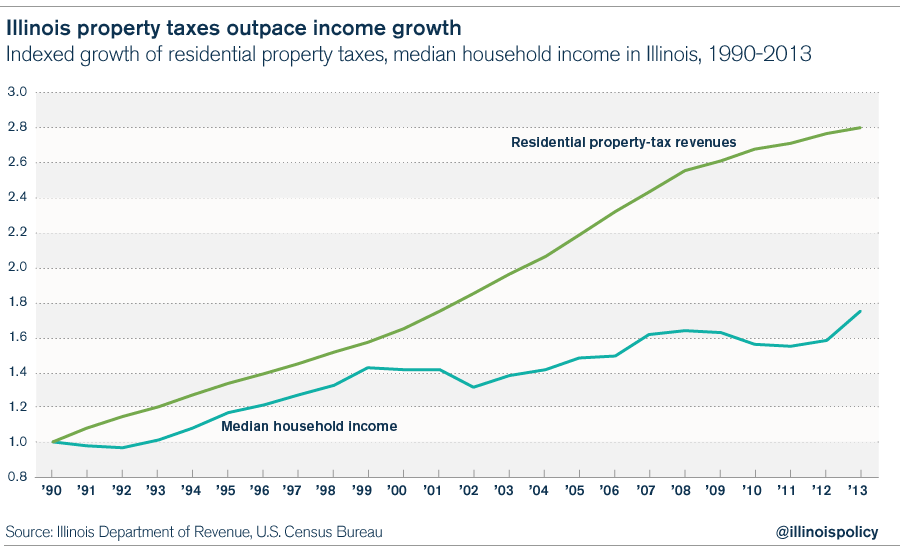

Illinois Property Taxes Growing 6x Faster Than Incomes Tonia Khouri

Redeem your sold taxes at the County Clerks Office.

. Ad Reduce property taxes for yourself or residential commercial businesses for commissions. Tax Year 2021 Second Installment Property Tax Due Date. Are Illinois property taxes extended.

The US Tax Filing Deadline was April 18 2022. The deadline for each quarterly instalment is July 1 October 1 January 1 and. Friday June 10th 2022 2nd Installment Due Date.

Friday September 2nd 2022. The first installment is due on March 1st and covers taxes from the previous year. Most often taxing entities tax levies are combined under a single notice from the county.

1st Installment Due Date. Has yet to be determined. Get Your Past-Due Taxes Done Today.

Ad Dont Face the IRS Alone. Last day to pay online or over the phone Interactive Voice Response by Credit Card. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Reduce property taxes for yourself or others as a legitimate home business. Last day to pay taxes to avoid tax sale-500pm - No postmark. 2 Bring cash or certified funds cashiers check or money order in the exact.

The second installment of the property tax bill is usually due on or. If You Owe Taxes Get A Free Consultation for IRS Tax Relief. Property tax bills for Cook County are due by years end according to County Board President Toni Preckwinkle.

Tax amount varies by county. At the annual tax sale individuals bid on the right to pay the delinquent taxes and penalties and then charge the property owner interest at an initial maximum rate of 18. 0 Federal 1499 State.

Get free competing quotes from leading IRS tax relief experts. NYC property tax could be paid quarterly if the home value exceeds 250000 or semi-annually. Then payments are allocated to these taxing authorities based on a predetermined payment.

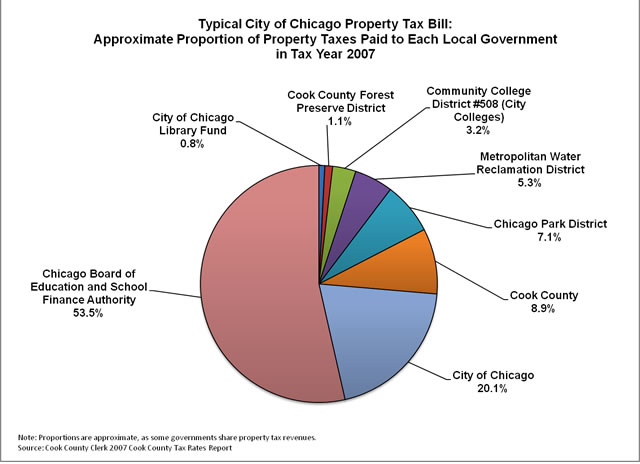

This next chart and graph shows the City and overlapping governmental taxing districts. The mailing of the bills is dependent on the completion of data by other local. City of Decatur Property and Overlapping Governmental Tax Rates.

Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet. 173 of home value. Illinois Property Tax Information If you need.

For now the September 1 deadline for the second installment of property taxes will remain unchanged. 2019 payable 2020 tax bills are. 100s of Top Rated Local Professionals Waiting to Help You Today.

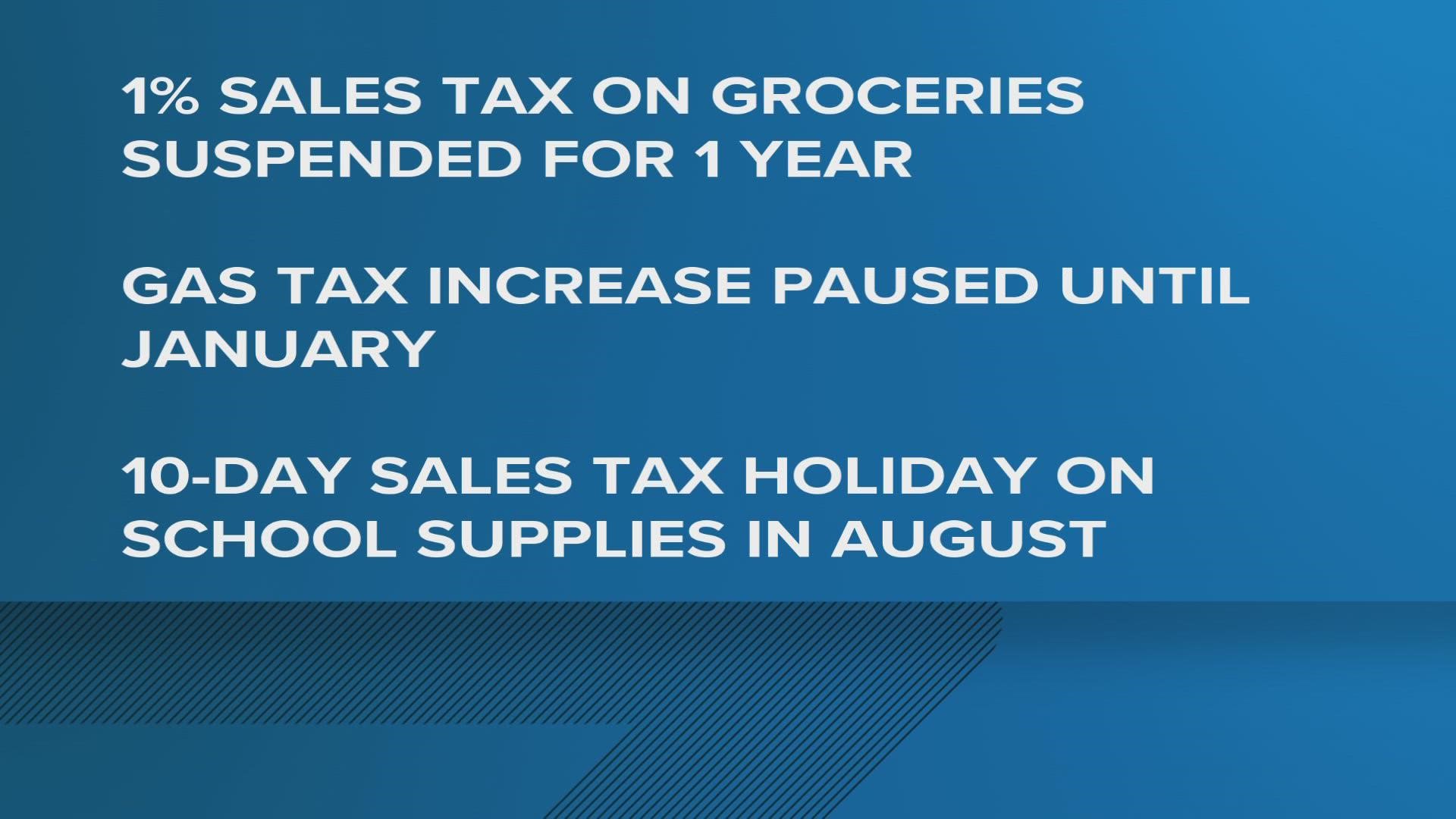

Illinois estimated 183 billion relief package which went into effect July 1 includes income and property tax rebates and a temporary cut in several sales taxes that should be. MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the. As you can see the City of.

The second installment is due on September 1st and covers taxes from the current year. Ad File a Late 2021 Tax Return Directly to the IRS. 1 Call 309 888-5190 for a redemption estimate.

Property Taxes Grow Faster Than Illinoisans Ability To Pay For Them

Illinois Tax Brief The Policy Circle

Illinois Rising Property Taxes Are Forcing Homeowners To Flee State

States With The Highest Lowest Tax Rates

Where Do Your Property Tax Dollars Go The Civic Federation

Property Tax Information Woodstock Illinois

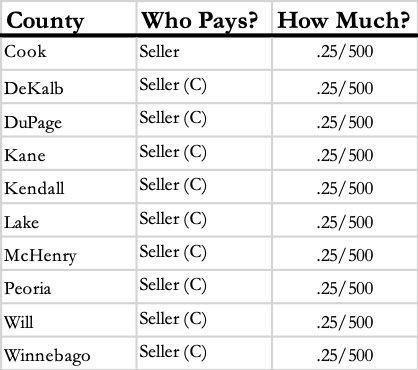

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Updated Illinois Property Taxes Center For Tax And Budget Accountability

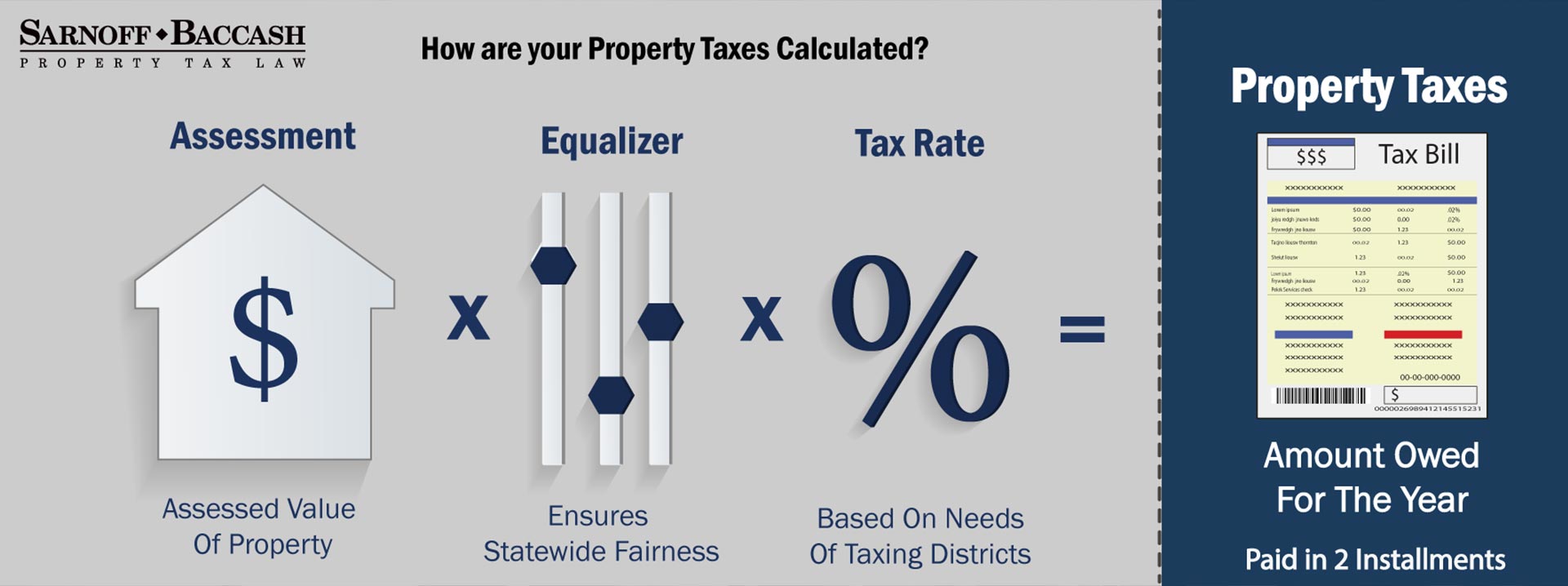

Property Tax Resources In Chicago Il Sarnoff Baccash

It S Not Just Illinois Homeowners That Suffer Businesses Pay Some Of The Nation S Highest Property Taxes Too Madison St Clair Record

Property Tax Task Force Disappoints Pension Consolidation Signed

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep

Home Is Where The Hurt Is How Property Taxes Are Crushing Illinois Middle Class

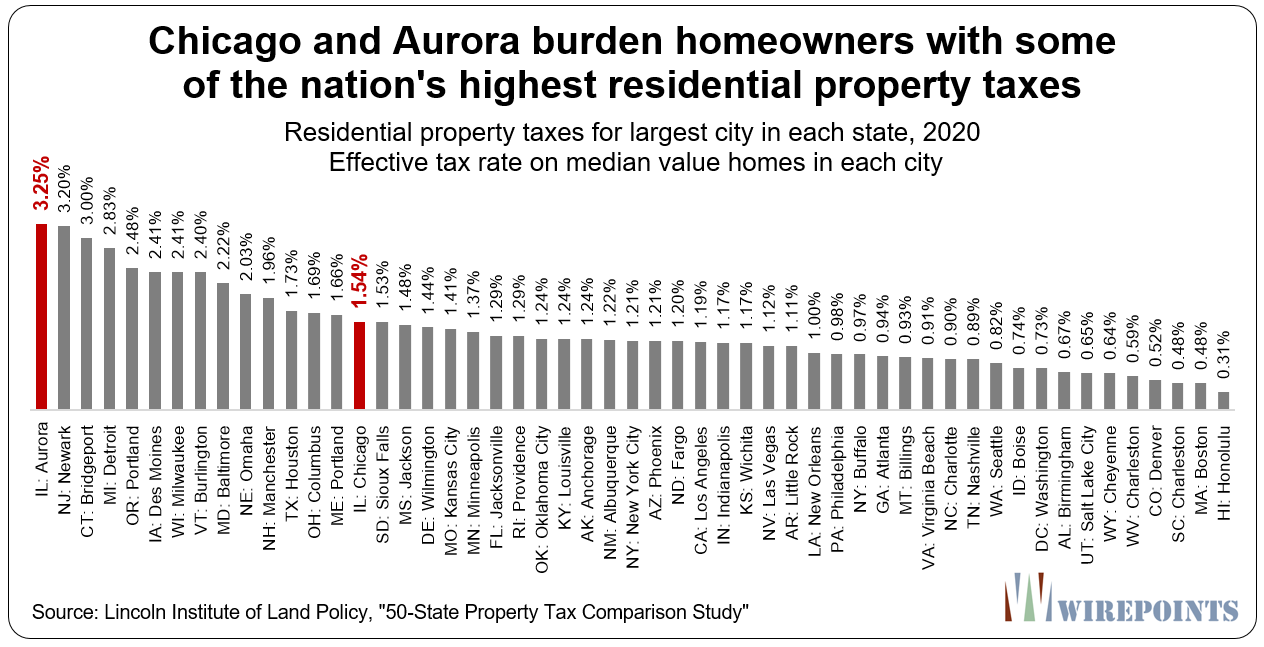

U S Cities With The Highest Property Taxes

Illinois Department Of Revenue

Cook County Property Tax Portal

Illinois 1 Year Tax Relief On Groceries Gas Property Taxes Begins Friday Ksdk Com